Simplify

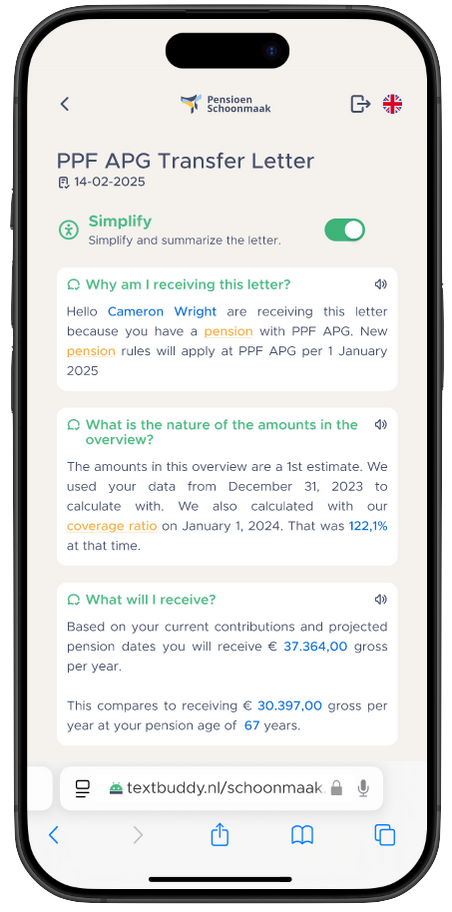

TextBuddy automatically simplifies pension texts into understandable language so that all participants—regardless of their language level—grasp what is communicated.

Translate

TextBuddy translates communications directly into over 20 languages. No extra translation costs—just inclusive communication.

Secure

TextBuddy runs on the Hyfen PensionLink platform: ensuring privacy, security, data minimization, and 100% compliance.

About TextBuddy

Clear language for everyone

TextBuddy automatically rewrites complex pension information into comprehensible B1-level language. This helps participants truly understand what is changing, avoiding confusion or legal jargon.

It strengthens trust in the fund and prevents unnecessary questions to the customer contact center.

Multilingual inclusion

The tool translates communications directly into more than 20 languages, including Turkish, Polish, Arabic, and English. This enables you to reach participants who have limited Dutch—without using external translation agencies.

This ensures truly accessible communication for a diverse participant base.

Privacy-proof and compliant

TextBuddy runs entirely within the Hyfen PensionLink platform. This means your fund immediately meets the highest standards for privacy and information security. Data minimization is built in, and participant data is never stored.

Text-to-Speech for improved accessibility

TextBuddy reads texts aloud in both Dutch and the selected target language. Ideal for participants with low literacy or visual impairments. The read-aloud feature lowers barriers and contributes to inclusive service.

Easy implementation

TextBuddy integrates seamlessly with existing communication formats and processes. Therefore, the tool can be easily embedded into the fund’s communication strategy—without hassle or system changes. You don’t need to alter your current workflow to get started immediately.

Low cost, pay-per-use model

TextBuddy operates on a usage-based pricing model: you only pay for what you actually use. There are no high implementation costs or license fees. This keeps costs low and predictable—ideal for funds looking to invest smartly in better communication.